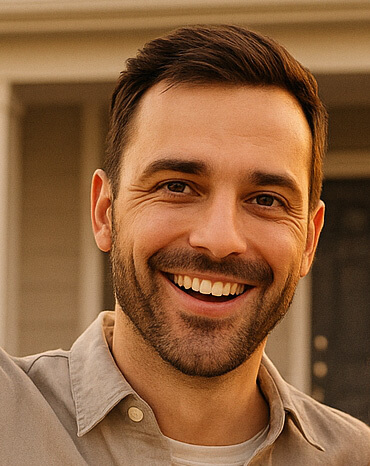

My name is Donna Price. I have 29 years of experience in the industry. Owning a mortgage brokerage for 20 years and helping agents negotiate on their own deals made me ready when I became a licensed agent myself. I have been successful as both a Listing and a Buyer’s Agent because I truly care about YOUR transaction!

I am a single Mom again, because I adopted my three beautiful grandchildren in January of 2020. I love to work out in the gym, and hike the beautiful Arizona mountains. I have lived here since I was four years old, and I am an expert in everything Arizona!

My Mortgage brokerage has a VA and First Responder program that gives back to our national and community heroes as well. Thank you for your service!

If I handle both sides of the transaction, I can save you money, and that helps your bottom line. Call or email me now, and let’s get started making you successful in your real estate ventures, and saving you money as well!

Misjudging market trends can cost you dearly.

Ignoring detailed inspections invites risk.

Skipping expert advice may lead to errors.

Overlooking your budget leads to financial strain.

Failing to review contracts can be very costly.

OR

Many overlook the impact of small missteps.

Shortcuts in the process can backfire quickly.

Financial oversights often haunt new buyers.

Neglecting repairs may diminish future value.

Skipping thorough inspections puts you at risk.

Through careful financial checks, buyer research, and expert consultations, you can navigate the home buying process more smoothly. It is essential to set a realistic budget and thoroughly inspect potential properties before making an offer.

Learn from others’ mistakes by questioning every step of your home buying journey. Do not let excitement override critical evaluations of the property’s condition and market value.

By avoiding the urge to compromise on important details, you set the stage for a secure and successful investment.

Step 1

Start by ensuring you have a clear perspective on your financial capabilities and property needs. Avoid the pitfall of believing every market trend guarantees profit. Instead, take time to research and plan.

Step 2

In the second step, scrutinize all associated fees – from commissions to closing costs. Overlooking these expenses can lead to unexpected financial burdens. A complete fiscal plan is essential.

Step 3

Lastly, ensure that you perform detailed inspections of the property. Do not assume that the seller has addressed all maintenance issues. An independent evaluation can reveal underlying problems.

Outstanding Insight.

Jhone

Expert Support.

The detailed guide informed me to scrutinize every financial detail and property condition before making a decision.

Scott

Valuable Knowledge.

Sarah

Explore common concerns such as financing challenges, inspection issues, and legal obligations. Our expert responses guide you through the complexities of home buying.

If you have concerns about affordability or property quality, our experts are available to clarify each step. Knowledge is your best asset.

Our team emphasizes thorough research and transparent communication. We encourage potential buyers to question every detail before making a commitment.

Remember, a successful home purchase means being vigilant about fees, maintenance issues, and contractual obligations. Take control of your buying experience.

Prepare questions in advance, and don’t be afraid to seek independent advice. Early planning can prevent costly mistakes in the future.

Our experienced advisors share step-by-step strategies to help you evaluate each property effectively, ensuring a wise investment decision.

Leverage our insights to build a sound financial plan. Avoid the common pitfalls by staying informed and proactive throughout the home buying process.